NEW YORK (TheStreet) - Shares of Tower Semiconductor (TSEM ) are dropping by 10.27% to $11.19 on heavy trading volume on Thursday afternoon, as Pomerantz law firm investigates allegations of questionable accounting practices on behalf of investors.

NEW YORK (TheStreet) - Shares of Tower Semiconductor (TSEM ) are dropping by 10.27% to $11.19 on heavy trading volume on Thursday afternoon, as Pomerantz law firm investigates allegations of questionable accounting practices on behalf of investors.

Spruce Point Capital Management published a report on the company today with evidence suggesting a "brazen accounting scheme to forestall [a] bankruptcy threat, " according to a statement from the law firm.

According to the report, the company may have heavily promoted a joint venture deal with Panasonic Corp. (PCRFY) to inflate its stock and convert its Series F debt to equity to relieve its debt burden.

"Tower has engaged in other questionable accounting maneuvers to give the appearance of strong Non-GAAP gross margins, profitability, and free cash flow, " the report said, according to the statement.

The Israel-based company operates an independent semiconductor foundry focused primarily on specialty process technologies.

About 4.13 million shares of Tower Semiconductor have been traded by this afternoon, well above the company's average of 477, 767 shares per day.

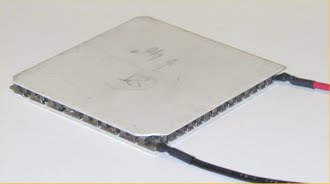

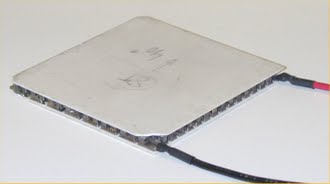

TSEM data by YCharts The thermoelectric effect is the direct conversion of temperature differences to electric voltage and vice-versa. A thermoelectric device creates a voltage when there is a different temperature on each side. Conversely, when a voltage is applied to it, it creates a...

The thermoelectric effect is the direct conversion of temperature differences to electric voltage and vice-versa. A thermoelectric device creates a voltage when there is a different temperature on each side. Conversely, when a voltage is applied to it, it creates a...

The thermopower, or thermoelectric power (also called the Seebeck coefficient) of a material is a measure of the magnitude of an induced thermoelectric voltage in response to a temperature difference across that material. The thermopower has units of volts per...

The thermopower, or thermoelectric power (also called the Seebeck coefficient) of a material is a measure of the magnitude of an induced thermoelectric voltage in response to a temperature difference across that material. The thermopower has units of volts per...