Nine of the Top 20 Semiconductor Suppliers are Forecast to Register Double-Digit Growth in 2014!

TSMC, MediaTek, and SK Hynix’s sales are each expected to jump by >20% this year.

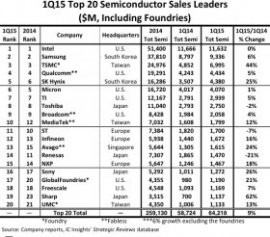

Later this month, IC Insights’ November Update to The 2014 McClean Report will show a forecast ranking of the 2014 top 25 semiconductor suppliers with the companies’ sales broken down on a quarterly basis. A preview of the forecast for the top 20 companies’ total 2014 sales results is presented in Figure 1. The top 20 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 2014 includes eight suppliers headquartered in the U.S., three in Japan, three in Europe, three in Taiwan, two in South Korea, and one in Singapore, a relatively broad representation of geographic regions.

This year’s top-20 ranking includes two pure-play foundries (TSMC and UMC) and six fabless companies. Pure-play IC foundry GlobalFoundries is forecast to be replaced in this year’s top 20 ranking by fabless IC supplier Nvidia. It is interesting to note that the top four semiconductor suppliers all have different business models. Intel is essentially a pure-play IDM, Samsung a vertically integrated IC supplier, TSMC a pure-play foundry, and Qualcomm a fabless company.

IC foundries are included in the top 20 ranking because IC Insights has always viewed the ranking as a top supplier list, not as a marketshare ranking, and realizes that in some cases semiconductor sales are double counted. With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant “holes” in the list of top semiconductor suppliers. Foundries and fabless companies are clearly identified in Figure 1. In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

As shown, it is expected to require total semiconductor sales of over $4.2 billion to make the 2014 top 20 ranking. In total, the top 20 semiconductor companies’ sales are forecast to increase by 9% this year as compared to 2013. However, when excluding the two pure-play foundries (TSMC and UMC) from the ranking, the top “18” semiconductor companies’ sales are forecast to increase by 8% this year, the same rate as IC Insights’ current forecast for total 2014 worldwide semiconductor market growth.

Figure 1

Outside of the top six spots, there are numerous changes expected within the 2014 top-20 semiconductor supplier ranking. In fact, of the 14 companies ranked 7th through 20th, 10 of them are forecast to change positions in 2014 as compared with 2013 (with NXP expected to jump up two spots).

More details on the forecasted 2014 top 25 semiconductor suppliers will be provided in the November Update to The McClean Report.

NOTE: IC Insights is currently taking orders for next year’s 2015 McClean Report, which will be released in January. If you need to fully understand the fast-changing IC market, you need to subscribe to the 2015 McClean Report.

Report Details: The 2015 McClean Report

The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2015) will feature more than 400 tables and graphs in the main report alone. A subscription to The McClean Report includes free attendance to one of The McClean Report half-day seminars that are presented by IC Insights’ President Bill McClean in January 2015. The McClean Report seminars will be held in the following locations:

• Scottsdale, Arizona on Tuesday, January 20

• Sunnyvale, California on Thursday, January 22

• Boston, Massachusetts on Thursday, January 29

In addition to the seminar, a subscription to The McClean Report includes free monthly updates from March through November (including a 250+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2015 edition of The McClean Report is priced at $3, 590 and includes an Internet access password. A multi-user worldwide corporate license is available for $6, 590.

RELATED VIDEO