By Brett Fox

By Brett Fox

Marc Andreessen famously said that the Silicon Valley was “dead” when he got here in the 1993.

And he was right: Software didn’t rule the Silicon Valley in 1993:

Hardware did, and semiconductor companies led the way.

Not anymore though.

It’s like watching water go down a drain: the water goes faster when it gets closer to the drain.

The rate of mergers and acquisitions is going at an unbelievably fast pace now.

Look at what’s happened just since the beginning of 2015:

- Avago’s proposed $47B merger with Broadcom

- Intel’s proposed $37B merger with Altera

- NXP proposed $12B merger with Freescale

- Cypress’ $5B merger with Spansion

Now, mergers have been part of any business segment since the beginning of time. The difference today is that there are no new companies replacing the merged companies:

New Funded Companies + Existing Companies – Merged Companies = Total Companies

With New Funded Companies essentially at zero, the total number of companies is going to go down.

Why are no new semiconductor companies being funded?

There are new semiconductor companies being formed. However, there are no new semiconductor companies being funded by venture capital firms. Well, the number is practically zero.

There are three key reasons why venture capital firms are not funding semiconductor companies any more:

- Semiconductor industry growth has slowed to roughly 5% per year. Yes, the semiconductor business is still over a $300B market, but growth is slowing.

- VC’s believe it takes $70M to get a semiconductor company off the ground and VC’s want a 10x return on their investment. I know from personal experience it can be done for considerably less. Ask yourself when the last $700M I.P.O. or sale of a semiconductor company occurred, and you see the problem.

- Most of the semiconductor investors in venture capital have been fired or retired. Venture capital is a kill or be killed business. You get put out to pasture pretty quickly when you don’t return capital to your investors.

These three reasons are a large part of why we are not seeing many semiconductor startups in the Silicon Valley. The real reason?

The technology bubble of 1996-2000 killed semiconductor startups.

Here’s why:

You have to start with the success of semiconductor investments during the bubble.

Valuations of public semiconductor companies during the late 1990’s expanded at a rapid rate. This was especially true for companies focused on wired and wireless communications.

AMCC, Broadcom, PMC-Sierra, and Vitesse were all trading at ridiculous multiples.

These companies used their stock currency to acquire startups in all-stock transactions at outrageous prices.

Many of these startups had very narrow visions: only a few products at best.

Many of these startups had very narrow visions: only a few products at best.

VC’s could “flip” companies and get a 10x or greater return on their investment in record time.

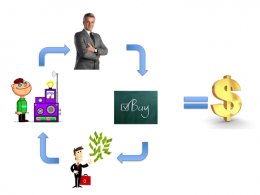

This system of rapidly flipping companies led semiconductor entrepreneurs and VC’s to feed off each other:

- Entrepreneurs gave VC’s what they wanted: narrowly focused companies developing a few products, and

- VC’s funded these companies expecting and getting a quick return.

Just look at the deals Broadcom did between 1999 and 2001:

Broadcom’s market capitalization peaked in Q3, 2000 at B on revenue of .1B. That’s gives Broadcom a price to sales ratio of almost 60!

Broadcom today has a market cap of B on revenue of .5B and a price to sales ratio of 3.8. Just for reference, Linear Technology has the highest price to sales ratio in the semiconductor industry today at ~7.

It was easy money for everyone.

Semiconductor entrepreneurs thought the road to riches was building these narrowly focused companies. And why wouldn’t they?

It all fit together nicely:

- Companies wanted products to fill out their product lines and…

- Venture capital provided the R&D “venture” money and…

- Entrepreneurs provided the knowhow and…

- Stock market “analysts” lauded each acquisition pushing stock prices ever higher.

There was a massive bubble in semiconductor stocks in 2000 that was ready burst.

Broadcom’s stock fell from a Q3, 2000 peak of $274 to $27 in Q1, 2001.

Need I say more?

Then, the cycle went in reverse:

- Companies didn’t have the inflated stock to buy startups for ridiculous valuations anymore, so…

- Venture capital firms had to hold the companies in their portfolios for longer and longer times before they could sell them…

- For non-inflated valuations hurting the returns for the funds and for entrepreneurs

The problem was that many venture capital firms kept investing in the same, narrowly focused semiconductor companies long after the bubble of 2000. Venture capital firms reached a conclusion:

You can’t make money in semiconductor investments anymore.

VC firms are not wrong.

It is very difficult to make money investing in narrowly focused semiconductor startups that are trying to go head-to-head with the Texas Instruments of the world.

What happens when you can’t make money?

Most VC’s funds have partnerships for the 10-year life of the fund. And most VC’s have multiple funds in play at any given time.

Semiconductor investing partners who hadn’t contributed to the success of the fund (that was most of them) either retired or were asked not to participate in the next fund.

The number of funds investing in semiconductor startups has shrunk significantly.

I saw the difficulties of raising capital for a semiconductor startup first-hand.

The market was pretty bleak when we started raising money in 2008. Combine a bleak market with The Great Recession, and it was really difficult to raise money.

RELATED VIDEO